Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices continue to rise, and market participants are currently finding it difficult to predict when prices will peak, increasing the complexity of procurement and operational decisions. Industry insiders believe that in the short term, supply-side constraints and sentiment-driven factors will continue to dominate the market, making it more likely for tungsten prices to rise than fall. In the medium to long term, whether prices can remain high will depend on the absorption capacity of downstream demand and the evolution of the macroeconomic and political environment. Furthermore, year-end stockpiling by companies, cash-out needs, and financial settlement arrangements could all become potential factors triggering market fluctuations.

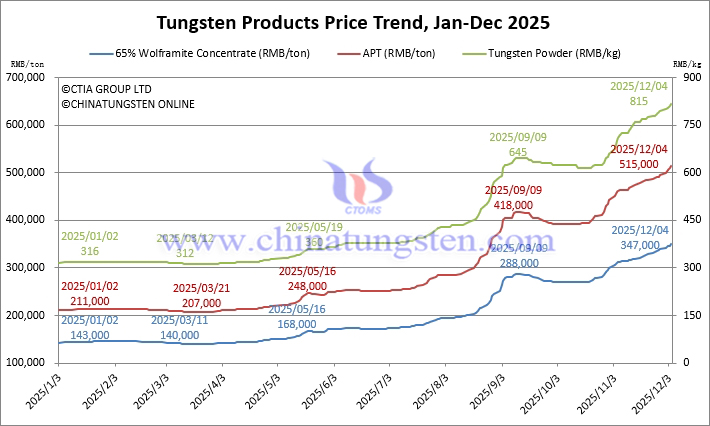

As of press time,

65% wolframite concentrate is priced at RMB 350,000/ton, up 144.8% from the beginning of the year.

65% scheelite concentrate is priced at RMB 349,000/ton, up 145.8% from the beginning of the year.

Ammonium paratungstate (APT) is priced at RMB 515,000/ton, up 144.1% from the beginning of the year.

European APT is priced at USD 735-780/mtu (equivalent to RMB 460,000-488,000/ton), up 129.6% from the beginning of the year. Tungsten powder price is reported at RMB 815/kg, up 157.9% from the beginning of the year.

Tungsten carbide powder is priced at RMB 785/kg, up 152.4% from the beginning of the year.

Cobalt powder price is priced at RMB 510/kg, up 200% from the beginning of the year.

70% ferrotungsten is priced at RMB 475,000/ton, up 120.9% from the beginning of the year.

European ferrotungsten is priced at USD 94-96/kg W (equivalent to RMB 465,000-475,000/ton), up 115.9% from the beginning of the year.

Scrap tungsten rod is priced at RMB 500/kg, up 127.3% from the beginning of the year.

Scrap tungsten drill bit is priced at RMB 475/kg, up 108.3% from the beginning of the year.Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices continue to rise, and market participants are currently finding it difficult to predict when prices will peak, increasing the complexity of procurement and operational decisions. Industry insiders believe that in the short term, supply-side constraints and sentiment-driven factors will continue to dominate the market, making it more likely for tungsten prices to rise than fall. In the medium to long term, whether prices can remain high will depend on the absorption capacity of downstream demand and the evolution of the macroeconomic and political environment. Furthermore, year-end stockpiling by companies, cash-out needs, and financial settlement arrangements could all become potential factors triggering market fluctuations.

As of press time,

65% wolframite concentrate is priced at RMB 350,000/ton, up 144.8% from the beginning of the year.

65% scheelite concentrate is priced at RMB 349,000/ton, up 145.8% from the beginning of the year.

Ammonium paratungstate (APT) is priced at RMB 515,000/ton, up 144.1% from the beginning of the year.

European APT is priced at USD 735-780/mtu (equivalent to RMB 460,000-488,000/ton), up 129.6% from the beginning of the year. Tungsten powder price is reported at RMB 815/kg, up 157.9% from the beginning of the year.

Tungsten carbide powder is priced at RMB 785/kg, up 152.4% from the beginning of the year.

Cobalt powder price is priced at RMB 510/kg, up 200% from the beginning of the year.

70% ferrotungsten is priced at RMB 475,000/ton, up 120.9% from the beginning of the year.

European ferrotungsten is priced at USD 94-96/kg W (equivalent to RMB 465,000-475,000/ton), up 115.9% from the beginning of the year.

Scrap tungsten rod is priced at RMB 500/kg, up 127.3% from the beginning of the year.

Scrap tungsten drill bit is priced at RMB 475/kg, up 108.3% from the beginning of the year.

Prices of Tungsten Products on December 4, 2025

Tungsten Price Trend from January to December 4, 2025