Analysis of Latest Tungsten Market from Chinatungsten Online

After rapid growth, the tungsten market has returned to a relatively stable state, leading to divergent sentiments among participants. Some holders are maintaining their inventory and supporting prices, while others are taking profits. Consumers exhibit a strong defensive mentality, cautiously negotiating prices based on rigid demand. The tungsten market is rife with undercurrents and increased uncertainty. Although tungsten product prices continue to rise, actual transactions are few.

In the tungsten concentrate market, the annual mining quotas have not been released, and the market remains tight with high prices. However, downstream financial pressures are intensifying, reducing the incentive to further increase prices, weakening the speculative atmosphere, and causing the market to become more rational.

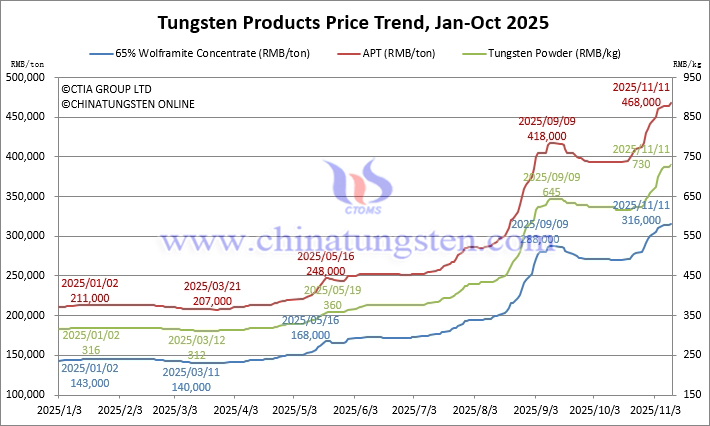

The price of 65% wolframite concentrate is reported at RMB 316,000/ton, up 121% from the beginning of the year.

The price of 65% scheelite concentrate is reported at RMB 315,000/ton, up 121.8% from the beginning of the year.

In the ammonium paratungstate (APT) market, there is a certain gap between the long-term contract purchase prices of several large tungsten enterprises and the spot market prices. According to industry insiders, limited resources circulating in the market outside of long-term contracts have led to chaotic spot market pricing and a widening price range.

Domestic APT prices were reported at RMB 468,000/ton, up 121.8% from the beginning of the year.

European APT prices were reported at USD 647.5-700/mtu (equivalent to RMB 408,000-441,000/ton), up 104.2% from the beginning of the year.

In the tungsten powder market, the upward trend continued due to cost increases, but downstream end-user acceptance was limited. The implementation of price increases for cemented carbide products remains to be seen, leading to increased market caution and sparse trading.

Tungsten powder prices were reported at RMB 730/kg, up 131% from the beginning of the year.

Tungsten carbide powder prices were reported at RMB 710/kg, up 128.3% from the beginning of the year.

Cobalt powder prices were reported at RMB 500/kg, up 194.1% from the beginning of the year.

In the ferrotungsten market, prices rose following raw material trends and were also influenced by international tungsten prices, resulting in a generally optimistic market sentiment recently. Downstream users maintained only essential purchases, with little willingness to stockpile on a large scale.

The price of 70% ferrotungsten is reported at RMB 430,000/ton, a 100% increase since the beginning of the year.

The price of ferrotungsten in Europe is reported at USD 92-94/kg W (equivalent to RMB 458,000-468,000/ton), a 111.4% increase since the beginning of the year.

In the tungsten waste and scrap market, liquidity is tight, risk appetite is low, participants have mixed opinions on price increases and decreases, trade negotiations are stalled, and short-term prices are fluctuating within a narrow range.

The price of scrap tungsten rods is reported at RMB 470/kg, a 113.6% increase since the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 437/kg, a 91.7% increase since the beginning of the year.

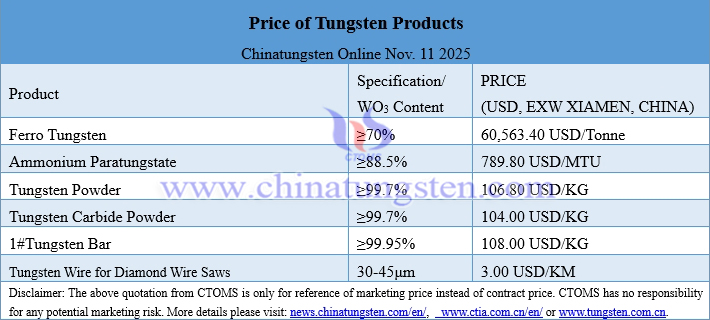

Prices of Tungsten Products on November 11, 2025

Tungsten Price Trend from January to November 11, 2025