Molybdenum market update on November 11, 2025

The domestic molybdenum market overall continues its broad-based decline, and the magnitude of the drop shows no clear signs of narrowing. Today, molybdenum concentrate, ferromolybdenum, and ammonium heptamolybdate prices decreased to around RMB 3,920 per ton-unit, RMB 255,000 per ton, and RMB 250,000 per ton, respectively.

From the bullish factors perspective, first, recent sharp declines in molybdenum product prices have generally strengthened suppliers' willingness to buy on dips; second, strong environmental crackdowns, high production costs, and currently relatively low molybdenum product prices have led some molybdenum manufacturers to voluntarily reduce output, slowing the pace of spot inventory growth in the market.

From the bearish factors perspective, first, influenced by the weak steel market, steel enterprises bid low on ferromolybdenum, thereby driving other molybdenum product prices down in tandem; second, against the backdrop of continuously declining international molybdenum prices, the domestic molybdenum market also struggles to warm up; third, lower international molybdenum prices combined with stronger RMB purchasing power will, to a certain extent, increase imports of molybdenum products into China.

On the news front, customs data show that in October 2025, China imported 503,000 tonnes of steel, decreased by 45,000 tonnes month-on-month, a drop of 8.2%; average price USD 1,593.0 per ton, decreased by USD 31.1 per ton month-on-month, a drop of 1.9%.

Imported iron ore 111.309 million tonnes, decreased by 5.017 million tonnes month-on-month, a drop of 4.3%; average price USD 100.6 per ton, increased by USD 3.6 per ton month-on-month, a rise of 3.7%.

Exported steel 9.782 million tonnes, decreased by 683,000 tonnes month-on-month, a drop of 6.5%; average price USD 684.4 per ton, increased by USD 5.3 per ton month-on-month, a rise of 0.8%.

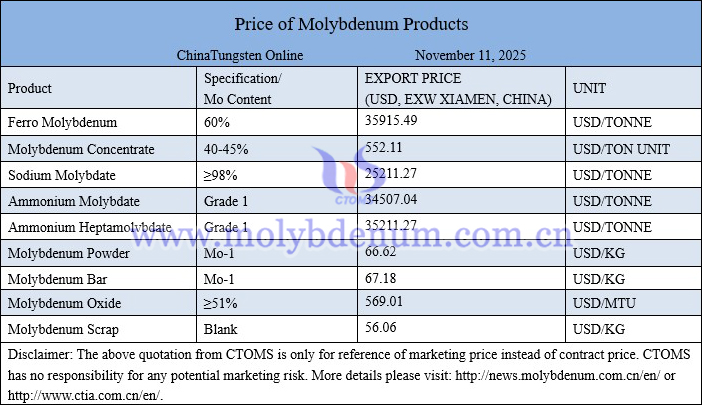

Price of molybdenum products on November 11, 2025

Molybdenum wire picture