Molybdenum market update on November 13, 2025

The domestic molybdenum market overall presents a pattern of continuous decline. Under the background of limited bullish support and strong bearish atmosphere, the buyer market holds a greater advantage, mainly manifested in the continued downward shift of the price center for most products.

Today, molybdenum concentrate, ferromolybdenum and ammonium heptamolybdate prices decreased again by approximately RMB 80 per ton-unit, RMB 5,000 per ton and RMB 2,000 per ton, respectively.

From the bullish factors perspective, first, influenced by the sharp decline in molybdenum product prices recently, downstream users' enthusiasm for buying on dips has increased; second, due to high production costs and stricter environmental policies, some molybdenum manufacturers have reduced output, and with current low molybdenum product prices, mainstream suppliers' willingness to ship is even lower.

From the bearish factors perspective, first, influenced by the pressured operation of the steel market, steel enterprises continuously press down ferromolybdenum procurement prices (steel bidding prices around RMB 230,000 per ton), thereby making it difficult for other molybdenum product prices to stabilize; second, traders' obvious "buy on rise, not on fall" sentiment makes it difficult to release market demand; third, the weak international molybdenum market situation forms a greater resistance to the warming of the domestic molybdenum market.

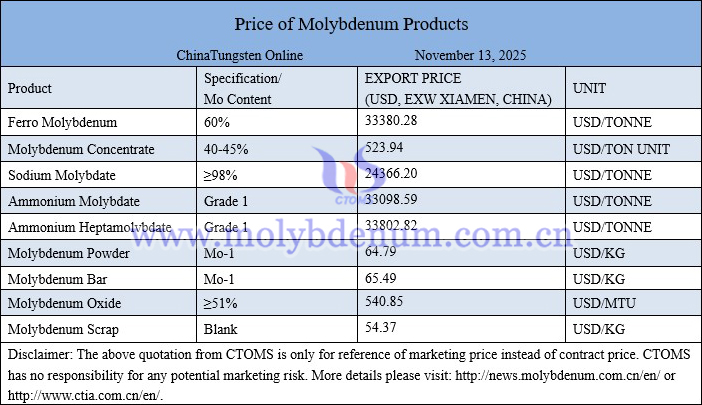

Price of molybdenum products on November 13, 2025

Images of yttrium molybdenum belt