Molybdenum market update on November 18, 2025

Domestic molybdenum market continues to exhibit a generally firm tone, caught in a tug-of-war between bullish and bearish forces. Consumer markets are gradually shifting from buyer dominance to seller control, evident in steadily rising raw material prices and strong hoarding sentiments among suppliers. Trading activity remains tepid, with limited new orders, as downstream demand shows no signs of robust recovery.

In the molybdenum concentrate segment, sentiment is relatively positive. Supported by growing downstream consumption, elevated production costs, and constrained spot supply, most molybdenum mining enterprises maintain firm pricing confidence. Transactions are centering around RMB 3,800/ton-degree.

The ferromolybdenum market sees moderately active trading, driven by steelmakers' keen interest in low-price procurement and suppliers' willingness to offload inventory. However, steel tender prices remain subdued at approximately RMB 240,000/ton.

For molybdenum chemicals and products, a watchful atmosphere prevails amid balanced supply-demand dynamics. Prices are primarily influenced by raw material fluctuations, but despite recent raw price rebounds, molybdenum chemicals and derivatives have held steady without upward movement.

According to National Bureau of Statistics data for October 2025: Crude steel output: 72.00 million tonnes, decreased by 12.1% year-on-year. Pig iron output: 65.55 million tonnes, decreased by 7.9% year-on-year. Steel products output: 118.64 million tonnes, decreased by 0.9% year-on-year. For January–October 2025: Cumulative crude steel output: 817.87 million tonnes, decreased by 3.9% year-on-year. Cumulative pig iron output: 711.37 million tonnes, decreased by 1.8% year-on-year. Cumulative steel products output: 1,217.59 million tonnes, increased by 4.7% year-on-year.

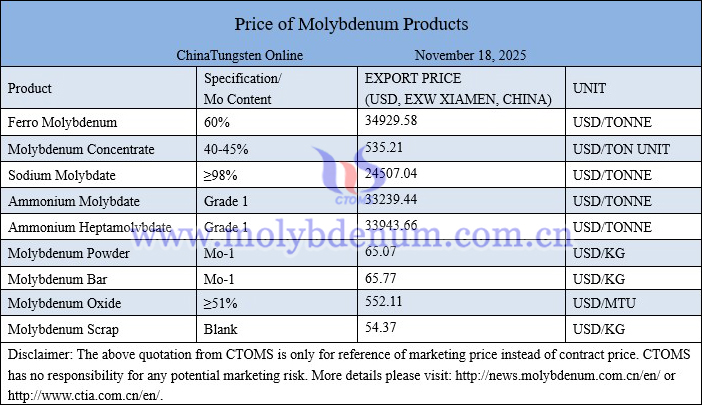

Price of molybdenum products on November 18, 2025

Images of molybdenum copper sheet