Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices maintained a steady upward trend, driven primarily by tight supply, cost support, and a combination of factors including market sentiment. While demand was supported by essential needs, the pace of end-user demand release was slow, creating significant resistance to high-price transactions. The entire industry chain operated primarily on an as-needed basis.

In the tungsten concentrate market, mine supply remained tight, and even with some releases, buyers were willing to purchase, thus suppliers maintained a strong willingness to hold prices.

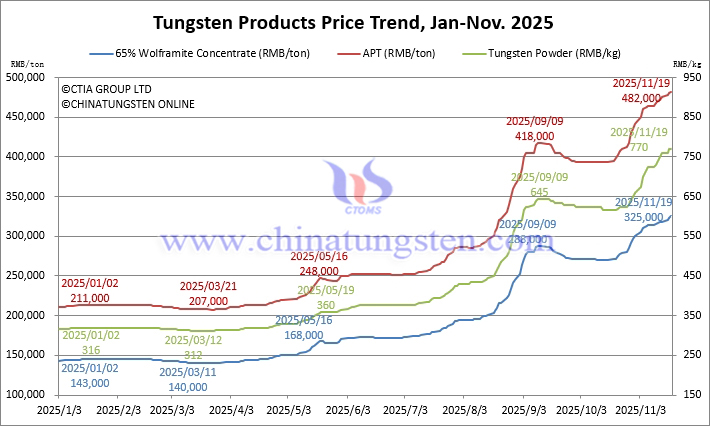

65% wolframite concentrate was priced at RMB 325,000/ton, up 127.3% from the beginning of the year.

65% scheelite concentrate was priced at RMB 324,000/ton, up 128.2% from the beginning of the year.

In the ammonium paratungstate (APT) market, tight supply and high costs kept prices firm, but downstream acceptance was limited, hindering overall market liquidity.

Ammonium paratungstate (APT) was priced at RMB 482,000/ton, up 128.4% from the beginning of the year.

European APT prices are reported at USD 673.75-705/mtu (equivalent to RMB 424,000-444,000/ton), up 108.9% from the beginning of the year.

In the tungsten powder market, prices remain firm driven by raw material costs, but downstream demand is releasing slowly, with limited new orders.

Tungsten powder prices are reported at RMB 770/kg, up 143.7% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 740/kg, up 137.9% from the beginning of the year.

Cobalt powder prices are reported at RMB 510/kg, up 200% from the beginning of the year.

In the ferrotungsten market, cost support is strong, downstream buyers are purchasing on an as-needed basis, and market transaction prices are steadily rising.

70% ferrotungsten prices are reported at RMB 440,000/ton, up 104.7% from the beginning of the year.

European ferrotungsten prices are reported at USD 92-94/kg W (equivalent to RMB 458,000-468,000/ton), up 111.4% from the beginning of the year.

In the tungsten waste and scrap market, influenced by a positive sentiment on the raw material side, sellers tentatively raised their prices. However, buyers remained hesitant, resulting in a narrow range of fluctuations in the market in the short term.

The price of scrap tungsten rods was reported at RMB 470/kg, up 113.6% from the beginning of the year.

The price of scrap tungsten drill bits was reported at RMB 437/kg, up 91.7% from the beginning of the year.

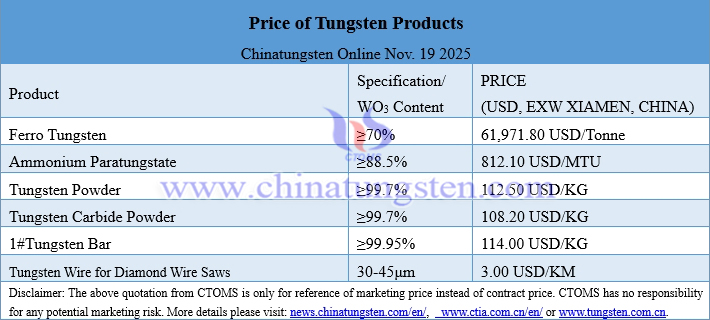

Prices of Tungsten Products on November 19, 2025

Tungsten Price Trend from January to November 19, 2025