Analysis of Latest Tungsten Market from Chinatungsten Online

The tungsten market is currently in a high-level stalemate. On the one hand, due to the scarcity of raw materials and their strategic resource attributes, holders maintain a strong bullish sentiment; however, on the other hand, due to uncertainties in the external political and economic situation and constraints from high production costs, downstream purchasing activity is weak. As the game between supply and demand intensifies, tungsten prices are generally fluctuating at high levels. Before the tight balance of raw materials changes, the supply side's support for the market remains strong, but transaction volume is limited by end-user acceptance and market risk aversion.

As of press time,

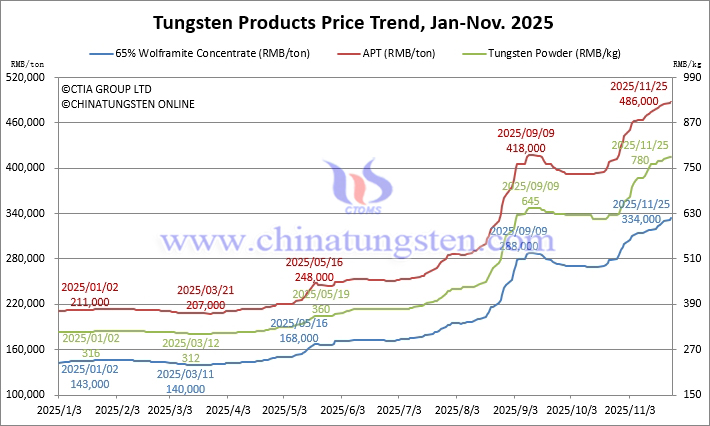

65% wolframite concentrate is priced at RMB 334,000/ton, up 133.6% from the beginning of the year.

65% scheelite concentrate is priced at RMB 333,000/ton, up 134.5% from the beginning of the year.

Ammonium paratungstate (APT) is priced at RMB 488,000/ton, up 131.3% from the beginning of the year.

European APT prices are reported at USD 735-780/mtu (equivalent to RMB 462,000-491,000/ton), up 129.6% from the beginning of the year.

Tungsten powder prices are reported at RMB 780/kg, up 146.8% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 750/kg, up 141.2% from the beginning of the year.

Cobalt powder prices are reported at RMB 510/kg, up 200% from the beginning of the year.

70% ferrotungsten is reported at RMB 450,000/ton, up 109.3% from the beginning of the year.

European ferrotungsten prices are reported at USD 92-95.5/kg W (equivalent to RMB 458,000-475,000/ton), up 113.1% from the beginning of the year.

Scrap tungsten rod prices are reported at RMB 480/kg, up 118.2% from the beginning of the year.

Scrap tungsten drill bits are reported at RMB 445/kg, up 95.2% from the beginning of the year.

Prices of Tungsten Products on November 25, 2025

Tungsten Price Trend from January to November 25, 2025