Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices maintained their upward trend, driven primarily by both tight supply and strategic premiums. Demand remained relatively cautious, mainly supported by rigid demand, with limited incremental contributions. The recent announcement of the "artificial sun" research program strengthened market expectations for the application potential and development prospects of tungsten alloys in the fusion energy field.

In the tungsten concentrate market, holders maintained a firm price stance, with supply remaining tight, supporting high prices.

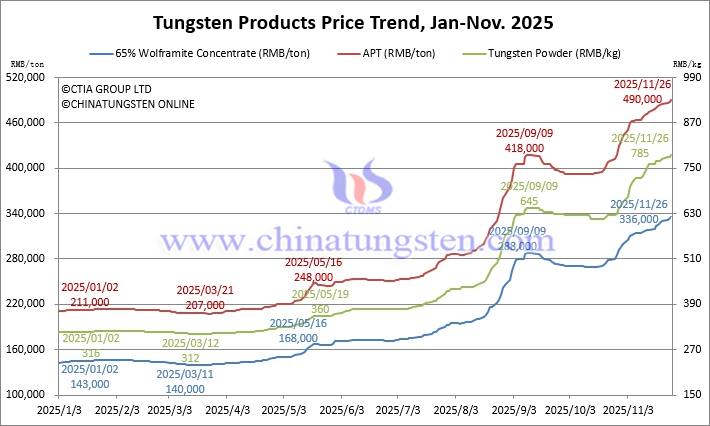

65% wolframite concentrate was priced at RMB 336,000/ton, up 135% from the beginning of the year.

65% scheelite concentrate was priced at RMB 335,000/ton, up 135.9% from the beginning of the year.

In the ammonium paratungstate (APT) market, cost support and demand pressures clashed, leading to cautious buying and selling by manufacturers, resulting in firm prices and limited operating rates.

Domestic APT prices were RMB 490,000/ton, up 132.2% from the beginning of the year.

European APT prices are reported at USD 735-780/mtu (equivalent to RMB 461,000-489,000/ton), up 129.6% from the beginning of the year.

In the tungsten powder market, high prices have suppressed market shipments, leading powder metallurgy companies to maintain a cautious strategy of negotiating on a case-by-case basis.

Tungsten powder prices are reported at RMB 785/kg, up 148.4% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 755/kg, up 142.8% from the beginning of the year.

Cobalt powder prices are reported at RMB 510/kg, up 200% from the beginning of the year.

In the ferrotungsten market, prices remain firm following the performance of raw materials, with downstream buyers purchasing only as needed, resulting in cautious market transactions.

70% ferrotungsten prices are reported at RMB 455,000/ton, up 111.6% from the beginning of the year.

European ferrotungsten prices are reported at USD 92-95.5/kg W (equivalent to RMB 456,000-474,000/ton), up 113.1% from the beginning of the year.

In the tungsten waste and scrap market, virgin tungsten prices remained firm, boosting recyclers' confidence and leading to a slight increase in recycled material prices. However, constrained by financial pressures, actual liquidity remained limited.

The price of scrap tungsten rods was reported at RMB 485/kg, up 120.5% from the beginning of the year.

The price of scrap tungsten drill bits was reported at RMB 450/kg, up 97.4% from the beginning of the year.

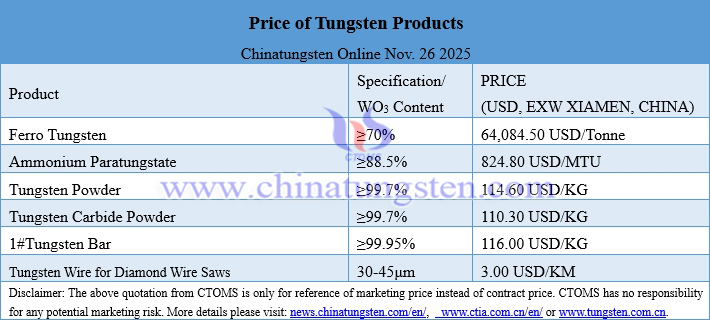

Prices of Tungsten Products on November 26, 2025

Tungsten Price Trend from January to November 26, 2025